Acorns Grow Inc., the company behind the Acorns app, announced Thursday morning that it has agreed to go public by merging with special-purpose acquisition company Pioneer Merger Corp (PACX) on a $2.2 billion deal. A special-purpose acquisition company (SPAC), also known as a blank check company, is a publicly traded company with the sole purpose of acquiring or merging with private companies, thus making them public.

Going public through a SPAC has been the more popular route of going public rather than the traditional IPO method. Another investing platform company, eToro, landed a $10 billion merge deal with SPAC company FinTech Acquisition Corp in March, and expects to go public in the third quarter of 2021.

The Acorns app launched in 2014, and now has over four million subscribers, with a majority being $1-per-month subscribers, and others being either $3-per-month or $5-per-month. Features of the app of include using spare change to invest in funds, and having access to a debit card backed by a designated checking account. Acorns expects to grow to 10 million subscribers by 2025. The company will be traded under the symbol of OAKS on the Nasdaq once it goes public.

Some speculate that Acorns SPAC announcement could be motivated by their competitor Robinhood having plans to go public as well. Robinhood is one of the biggest investment platforms for younger audiences, and they may even allow retail investors to buy their IPO shares before it goes public. Institutional investors tend to only have access to buy shares of a company at IPO prices, but with Robinhood’s IPO Access, retail investors can get in on the fun too with select companies.

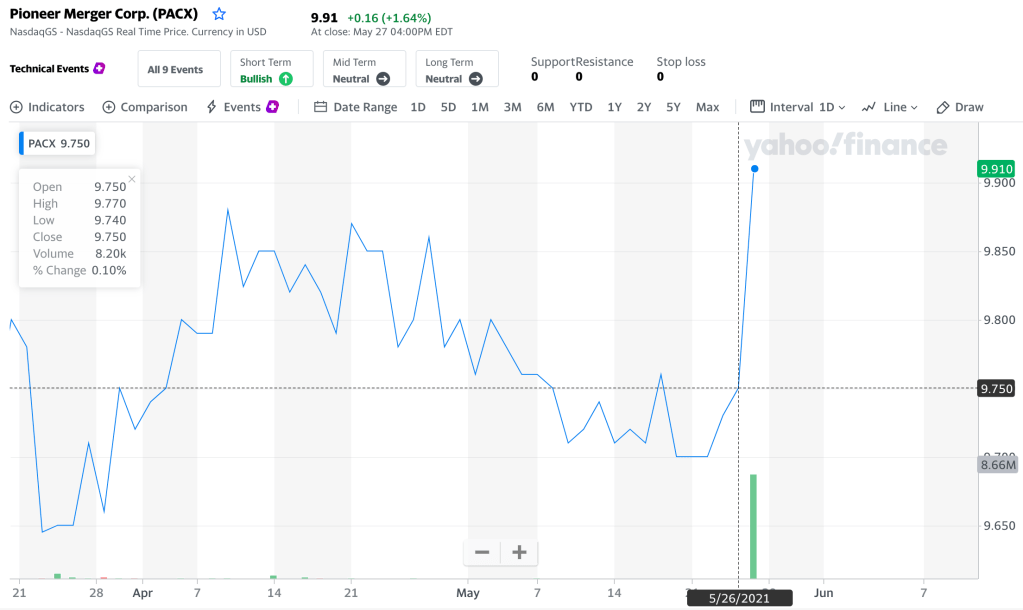

The stock of Pioneer Merger Corp increased by nearly 2% Thursday, of course influenced by the merger between them and Acorns. It will be interesting see how PACX stock will be affected once Acorns actually goes public, as well as what Acorns opening price will be once it hits the market.